See This Report about copyright Installment Loans

Wiki Article

The Ultimate Guide To Installment Loans Online

Table of ContentsThings about copyright Installment LoansInstallment Loans copyright for BeginnersThe Basic Principles Of copyright Installment Loans Not known Factual Statements About copyright Installment Loans The Buzz on copyright Installment LoansAll About Fast Installment Loans Online

"Installment funding" is a wide, general term that refers to the frustrating bulk of both personal as well as industrial fundings encompassed borrowers. Installation loans include any kind of lending that is settled with on a regular basis scheduled settlements or installments. If you are thinking of getting an installment loan, there are some pros and also cons to think about.Brokers Lamina Review from Lamina Brokers on Vimeo.

Installation lendings are personal or industrial financings that debtors have to repay with on a regular basis set up payments or installations. For each and every installation settlement, the debtor pays off a part of the primary obtained as well as pays interest on the finance. Instances of installation loans consist of vehicle loans, mortgage, individual finances, and also student financings.

The normal repayment quantity, typically due monthly, remains the same throughout the lending term, making it simple for the debtor to spending plan ahead of time for the needed settlements. Borrowers typically need to pay various other costs in addition to interest costs on installation lendings. Those can include application processing fees, car loan source charges, and possible extra fees such as late repayment fees.

Some Known Details About copyright Installment Loans

Besides mortgages, which are sometimes variable-rate financings, where the rate of interest can transform throughout the regard to the loan, almost all installment lendings are fixed-rate fundings, suggesting that the rate of interest charged over the term of the financing is fixed at the time of borrowing. Installment financings may be either secured (collateralized) or unsecured (non-collateralized).Some installment fundings (commonly described as individual finances) are expanded without security being called for. These unsafe fundings are made based upon the borrower's creditworthiness, typically demonstrated through a credit history, as well as their ability to settle as suggested by their income as well as possessions. The rates of interest charged on an unprotected funding is normally greater than the price on an equivalent secured finance, showing the greater danger of non-repayment that the financial institution approves.

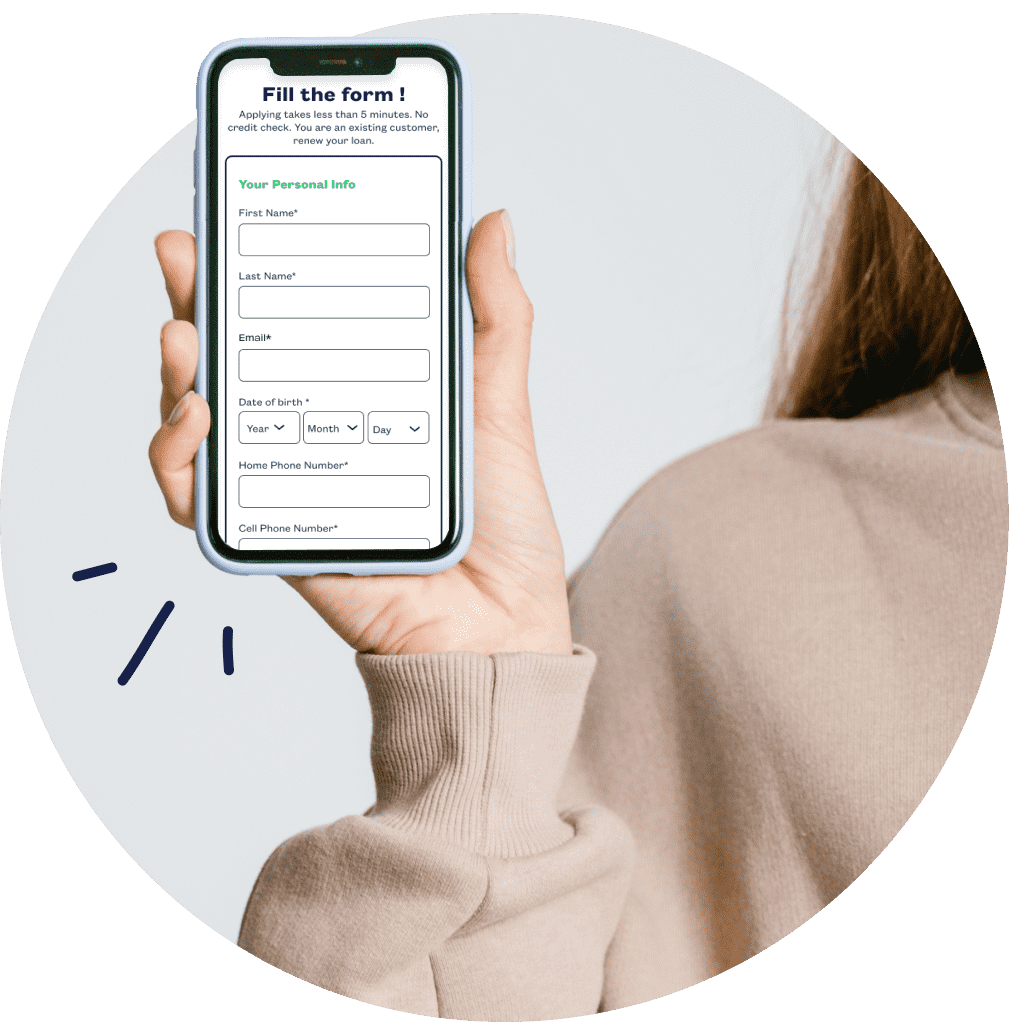

A consumer applies for an installation finance by filling up out an application with a lending institution, normally defining the function of the lending, such as the acquisition of an automobile. The loan provider needs to go over with the debtor different alternatives, such as the down settlement, the regard to the funding, the payment routine, and also the payment quantities.

The 2-Minute Rule for copyright Installment Loans

The lender will certainly additionally assess the debtor's credit reliability to figure out the amount of credit score and the funding terms that the lending institution agrees to supply. The borrower normally settles the financing by making the called for repayments on a monthly basis. Debtors can normally save rate of interest fees by settling the car loan before the end of the term established in the finance contract, unless there are charges for doing so.Settling an installment car loan on schedule is an excellent means to construct your credit score. Repayment history is the single crucial variable that contributes to your credit history, and also a long record of on-time payments is excellent for your debt ranking. On the various other hand, your credit history can take a hit if you do not make timely payments or you fail on the loanwhich is a major warning in the eyes of loan providers.

Yes, you may have the ability to get an installation finance even if you have negative credit scores. You will usually have to pay a greater interest rate than if your credit scores was in far better shape. You may additionally be more most likely to be approved for a safeguarded finance than an unprotected one in that circumstance.

Some Known Details About copyright Installment Loans

An installation financing is a breakthrough that has the arrangement of being paid back over a details duration of time through a set number of scheduled payments. The you could try this out tenure of the lending may extend from a few months to up to thirty years.

Bad Credit Installment Loans Online for Beginners

Extra often than not, these kinds of loans are approved and serviced locally, and also require the client to repay back the principal in addition to the accumulated interest, through regular repayment installments. The regularity and schedule of the payment installations are dealt with prior to the disbursement of the lending.

The simplicity as well as rate of using, as well as getting accessibility to the needed advancement, supplies an included advantage to the one in need. Why waste your precious time encountering the loan provider's workplace, when you can obtain the loan from the convenience of your residence! All you need to do is, open your laptop as well as see the loan provider's web site where you can simply fill the financing application and also obtain the cash within 24-hour.

See This Report about Fast Installment Loans Online

deals you our unique Cashco flex finances that can pertain to your rescue when you remain in an economic crisis. There are several instances in an individual's lifetime that command prompt monetary attention, as well as many of individuals are not truly outfitted with the huge quantities of cash needed to take care of them.Or, you all of a sudden experienced an automobile click here for info malfunction, as well as wished you had some added money stored for conference unanticipated expenses such as this. Whatever the requirement of read the hour perhaps, the bottom line is that you call for a great deal of money quickly (fast installment loans online). There may be certain credit-rating problems, which are restraining the financial institution from providing you an advance.

Report this wiki page